Income Tax Return (ITR) is a form that a person needs to submit to the income tax department of India. It contains all the information about the Person’s income and taxes paid to the Government during the financial year, i.e. starting on 1st July and ending on 31st July of the next year.

Income can be of various form such as –

- Income from salary

- Income from house property

- Income from capital gain

- Profits and gains from business and profession

- Income from other sources such as dividends, interest on deposits, royalty income, winning on lottery, etc.

There are 7 types of Income Tax Return forms available during filing the ITR which is – ITR-1, ITR-2, ITR-3, ITR-4, ITR-5, ITR-6, ITR-7. All this form is based on the nature and amount and type of the taxpayer.

Contents

ITR Forms Explanations-

| Particulars | Details |

|---|---|

| ITR-1 | This form can be filled by resident individuals having total income of upto 50 Lakhs from the following sources.

1. Salary |

| ITR-2 | To be filed by Individuals and HUFs who are not eligible to file form ITR-1 and don’t have income from profits and gains from business or profession |

| ITR-3 | To be filed by Individuals and HUFs having income from profits and gains from business or profession |

| ITR-4 | To be filed by resident individuals, HUFs and firms (other than LLP) who are residents having total income upto ₹ 50 lacs and having income from business or profession computed under section 44AD, 44ADA or 44AE |

Note – Individuals have to compulsorily file ITR through online mode.

How to File ITR (Income Tax Return) Online?

Nowadays, Filing ITR Online is very easy and simple. Filing Income Tax Return is very important for everyone. Anybody who is less than 60 years of age and has an annual income of more than Rs 2.5 lakh has to file income tax returns, according to the Income Tax Act. For senior citizens, the cut-off is Rs3 lakh, and for those who are more than 80 years old, the cut off is Rs5 lakh.

So, we are going to share Step by Step guide how to file ITR (Income Tax Return) Online-

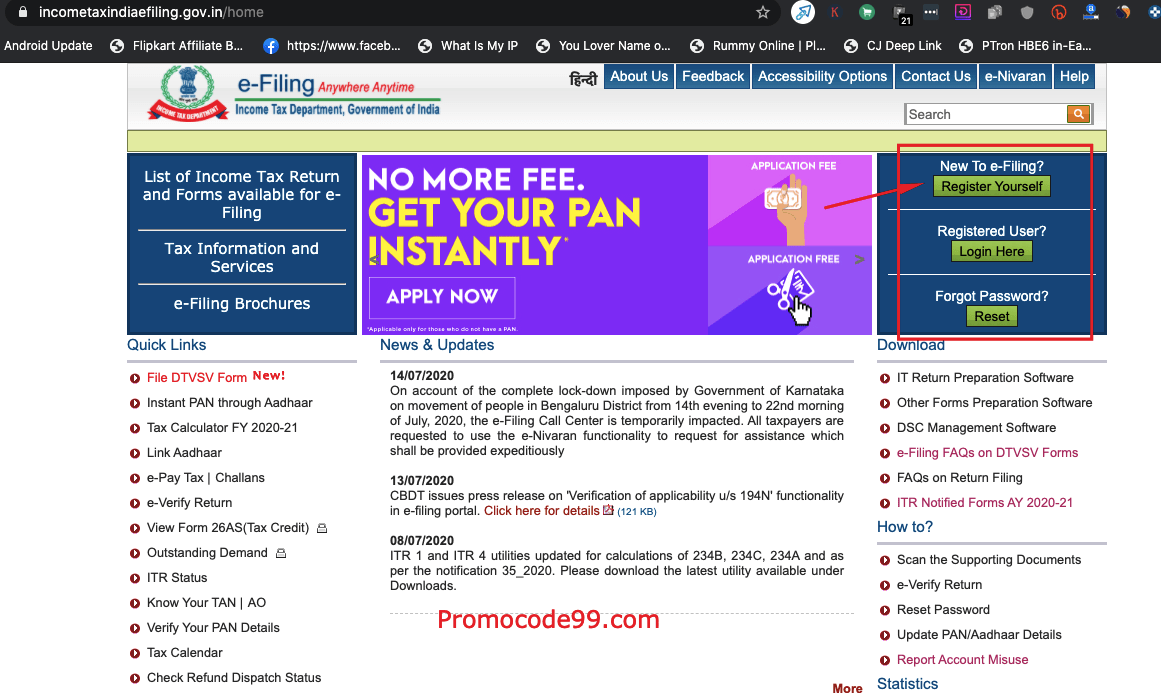

- First, Goto the Official Income Tax Website using the below link.

Income Tax India Official Website

- Now Register on Income Tax India Official Website through Your PAN Card

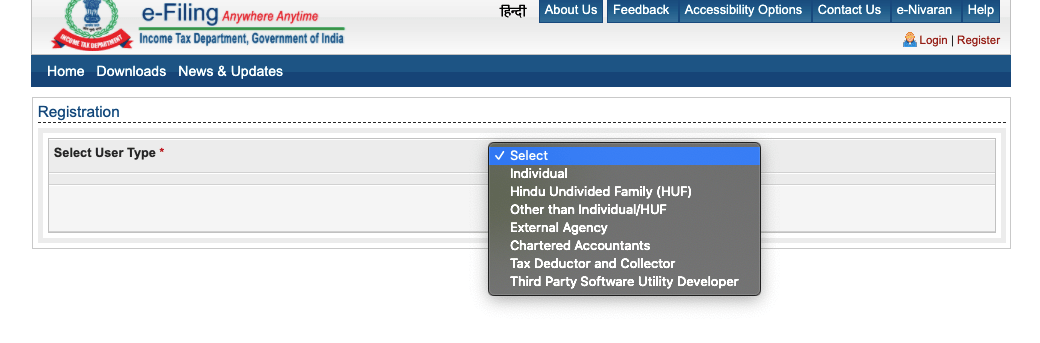

- Select the User Type

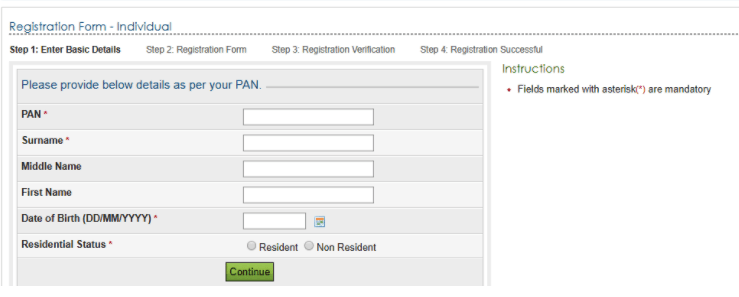

- On The Next Step, Fill all the Basic details Like Name, Pan Card No, Date of Birth, etc.

- Now You Need to Verify Your PAN Card and Done

- Now Finally, You need to activate your account via OTP sent to Email Address & Mobile Number.

- Once the registration is Done, You Can File ITR Online according to your type and Income.

Must Check – Flipkart Upcoming Sales / Amazon Upcoming Sales

Top Benefits of Filing Income Tax Return (ITR)-

Now, the most important question asked by users Why Filing ITR is important? So, we are going to share the Top Most benefit for Filing ITR & why Filing ITR is important nowadays. So, keep reading until the end.

Those with the Gross Income Total (GTI) below 2.5 lakhs are not required to file an ITR. This limit is 3 lakhs for people between the age of 60 to 80, and 5 lakhs for people above the age of 80.

1. Easy Loan Approval

When it comes to filing a loan for your Two-wheeler, Car & Home loan, an ITR receipt turns out to be an important document. It makes it easy for the bank to approve your loan according to your ITR Report. For the Loan type Personal Loan or Home Loan, you will be required to submit income proof such as your income tax returns.

2. Claims Tax Deductions

One of the biggest benefits of Filing ITR is Claiming Tax Deductions. If you paid lots of income tax in the form of TDS every month from your salary or income, you can claim a refund for the same by filing tax returns.

3. Avoid penalties or notice from the tax department

From the Financial year, 2017-18 Rs 5,000 to 10,000 would be levied for non-filing of ITR. You may receive notice from the tax department for non-filing of Income-tax return. To avoid penalties or notice from the tax department, you must file your Income-tax return.

4. Visa Processing

Embassies of developed countries like the United States, United Kingdom, Canada, and Australia ask for ITR receipts of the past years to process your visa application. They are very particular about your tax compliance and hence, you are asked to furnish past ITR receipts. This helps them assess your income and ensure that you are able to take care of the expenses on your trip.

5. Important for Large Insurance Cover

If you want to apply insurance cover for above 50 lacs then insurance companies required ITR receipt. The annual income and tax returns help insurers to determine the exact premium amounts and security. Most of the time, ITR is a necessary document for buying insurance cover.

If You Still Need Any Help Regarding ITR Filing and Want to File Your Income Tax Return (ITR) at Reasonable Price then Don’t forget to Contact Us via the below form.

Must Check – Banned Chinese Apps Alternatives to Use in India

1 thought on “What is ITR (Income Tax Return) & It’s Benefits?”